Table of Contents

- Introduction

- Understanding Web3 Domain Staking

- Earning Passive Income from Staking

- Community Governance through Domain Staking

- Risks and Benefits of Web3 Domain Staking

- Conclusion

- Resources

Introduction

The rise of Web3 domain staking is redefining how digital identity, ownership, and participation are managed online. Through blockchain and smart contracts, individuals and businesses can not only own decentralized domains permanently, but can also put their assets to work by staking them for returns or governance power. This dynamic shift is rooted in the growing demand for autonomy, censorship-resistance, and true digital sovereignty.

Web3 domain staking enables users to lock up domains or associated tokens, opening new avenues for passive income, and actively participating in community governance. Unlike the traditional DNS model—where domains are rented from centralized authorities like ICANN and perpetually renewed for a fee—the Web3 approach guarantees ownership, enhanced security, and invites users to help shape platform evolution.

However, with the promise of greater empowerment come notable risks: platform security concerns, regulatory ambiguity, and technical complexity are all points new users must consider. Strategic staking can yield significant rewards—financial, reputational, and participative—but informed vigilance is required to mitigate threats such as smart contract vulnerabilities and volatile rewards.

In the following sections, we explore the full spectrum of Web3 domain staking: from foundational definitions and platform choices, to earning mechanisms, community power, risk management, and the exciting trends shaping this rapidly expanding landscape.

What is Web3 Domain Staking?

Staking in Web3 domain services refers to the process of locking digital assets—such as tokens or domain rights—on a blockchain to earn rewards, contribute to network security, or gain governance privileges. Unlike conventional domains needing annual renewal, Web3 domain staking permanently places ownership on-chain.

Platforms offering Web3 domains, like Freename.io and Unstoppable Domains, leverage smart contracts, so when you stake a domain or related tokens, you participate in consensus, security, and sometimes even voting. This technical shift away from centralized registration creates user-friendly digital identities, unlocks passive earning potential, and aligns with the ethos of a decentralized internet.

Importance of Staking in Decentralized Domains

The move to blockchain-based domain staking is about more than just ownership: it’s about control, security, and earning potential.

Staking ties user interests directly to platform health—locked tokens provide security, minimize bad actors, and stabilize ecosystems. For many, the biggest draw is the ability to generate staking rewards—APR rates can range from 5% to 20% depending on platform and market conditions. But perhaps more importantly, staking empowers users to take part in governance participation, influencing platform direction, voting on proposals, and driving innovation from the ground up.

Web3 domain staking marks a paradigm shift: from renting your digital identity to truly owning—and leveraging—it.

Understanding Web3 Domain Staking

How Keyword Staking Works

Keyword staking on Web3 domain platforms enables users to select a unique keyword or domain and “stake” tokens or rights associated with it using blockchain-based smart contracts. This not only reserves the digital asset but can enhance its searchability, visibility, and associated value across the platform ecosystem.

The operational flow generally follows these steps:

- A user selects a domain/keyword on a platform such as Freename.io.

- The smart contract locks specified tokens (usually native to the platform) against that domain.

- Staked domains may receive increased exposure in decentralized search, ranking higher in platform listings.

- Users earn staking rewards, often in the form of additional tokens or a share in transaction fees, distributed through the smart contract protocol.

- Community staking may also grant users eligibility for governance or exclusive platform features.

Unlike pure proof-of-stake networks, keyword staking introduces a utility layer, blending visibility, governance rights, and long-term investment—all underpinned by blockchain security.

Supported Platforms and Technologies

Several pioneering platforms are championing decentralized staking:

Freename.io stands out as a leader in the blockchain domain space, offering seamless registration of Web3 TLDs, decentralized keyword staking, and governance opportunities. Freename leverages blockchain protocols for censorship resistance, user privacy, and direct domain integration with NFTs and wallets (Web3 domain platforms).

Other platforms, such as Unstoppable Domains, focus on permanent ownership—domains once purchased are yours forever, no renewal fees. Meanwhile, D3 and World3 extend these functionalities by adding fractional ownership, bundled domain staking, and advanced liquidity features, pushing the boundaries of traditional domain economics (staking web3 domains for community governance).

Underlying these innovations are blockchains like Ethereum, which power domain staking protocols, integrate with NFT standards, and enable seamless DeFi and dApp interoperability. File storage protocols such as IPFS provide decentralized, tamper-resistant data hosting—crucial for truly censorship-proof domains.

Staking Mechanisms and Protocols

At the heart of Web3 domain staking are sophisticated staking mechanisms such as:

- Proof-of-Stake (PoS): Network participants lock tokens as collateral to validate transactions and secure the chain, earning staking rewards in the process.

- Delegated Staking: Domain owners can delegate their staking rights to trusted validators, earning a share of rewards and reducing the need for always-online infrastructure.

- Keyword/Utility Staking: Unique to domains, where staking enhances keyword or domain function (visibility, governance participation, or rewards distribution).

- Tokenization Models: Platforms like D3 enable fractional and tokenized domain ownership, unlocking liquidity and making domains tradeable DeFi assets.

These protocols are not just technical choices—they determine reward rate structures, platform security, participation pathways, and even regulatory compliance. Security best practices—multi-sig, code audits, formal verification—are fundamental to building user trust.

Earning Passive Income from Staking

The economic incentive is a powerful motivator for adoption. Staking web3 domains for passive income streams is now a realistic route for both tech pioneers and mainstream users, thanks to competitive staking rewards and low technical barriers.

Reward Structures and Rates

Returns from staking Web3 domains vary by platform and protocol. The most common rewards include:

- Additional native tokens distributed to stakers

- Automatic entry to platform-wide lotteries, airdrops, or exclusive NFT drops

- A share in transaction or registration fees

Average APR rates for staking rewards typically range between 5% and 20%, depending on network health, token supply, and user participation. Some platforms incentivize early adopters with higher rates or bonuses, especially during network bootstrap phases.

The actual value of rewards can fluctuate due to token price volatility—a hallmark of decentralized ecosystems. Stable, audited protocols and decentralized domains with high demand are generally more likely to offer sustainable returns.

How Staking Increases Domain Value

Staking a domain isn’t just about earning tokens. When a domain is actively staked, it often gains:

- Increased visibility in decentralized search rankings

- Enhanced trust as a signal of platform commitment

- A history of participation, boosting resale value and NFT domain appeal

Platforms supporting NFT domains often allow the staked domain itself to become a liquid digital asset. This blend of utility and investment means that well-staked domains may command a premium in secondary markets, particularly in trending categories or with desirable keywords.

Getting Started with Staking

For newcomers, the path to staking is more accessible than ever. To begin, follow these essential steps:

- Obtain a Web3 domain – Register via a platform like Freename.io or follow a how to get a Web3 domain guide for step-by-step onboarding.

- Connect a blockchain wallet compatible with the platform (e.g., MetaMask, WalletConnect).

- Navigate to the staking portal—locate your purchased domain or keyword.

- Initiate staking—lock eligible tokens or domain rights via a smart contract interface.

- Track rewards and manage participation using platform dashboards and analytics.

It’s important to review the staking web3 domains beginner guide and familiarize yourself with individual platform requirements, terms, and payout schedules before committing assets.

Community Governance through Domain Staking

Staking in Web3 is not a passive act; it is a means of governance participation, allowing stakers to directly shape policy, direction, and platform value. This development bridges user and platform in a mutually reinforcing relationship.

Voting Rights and Governance Models

Platforms supporting staking web3 domains for community governance allocate voting rights to participants based on staked assets. The mechanics generally follow:

- Voting proportional to staked tokens/domains, enabling proposal submissions and weighted choices

- On-chain execution of governance proposals via smart contracts ensures transparency

- Incentives for active participation—extra rewards, badges, or reputation gains

This decentralized governance model is proven to increase participant engagement and align the long-term interests of users, developers, and investors.

Platform Support for Governance

Several platforms now integrate robust governance tools:

- Freename.io and World3 employ community-first strategies, anchoring platform upgrades and feature proposals to on-chain voting (staking web3 domains for community governance).

- Some networks support DAO-like structures, making community input central to every code or policy change.

Integration with browser-based wallets and the Web3 browser extension ecosystem has further propelled user participation, making governance both frictionless and highly auditable.

Security and Transparency in Governance

Trust is the foundation of decentralized decision-making. Platforms achieve this via:

- Audited smart contracts and open-source codebases

- Multi-signature approval systems for high-stakes proposals

- On-chain publication of all votes and decisions, ensuring crypto-verified transparency

Additionally, features like public dashboards and real-time analytics make it easy for every stakeholder to track voting power, proposal status, and governance health. This demonstrably enhances platform security and user trust.

Risks and Benefits of Web3 Domain Staking

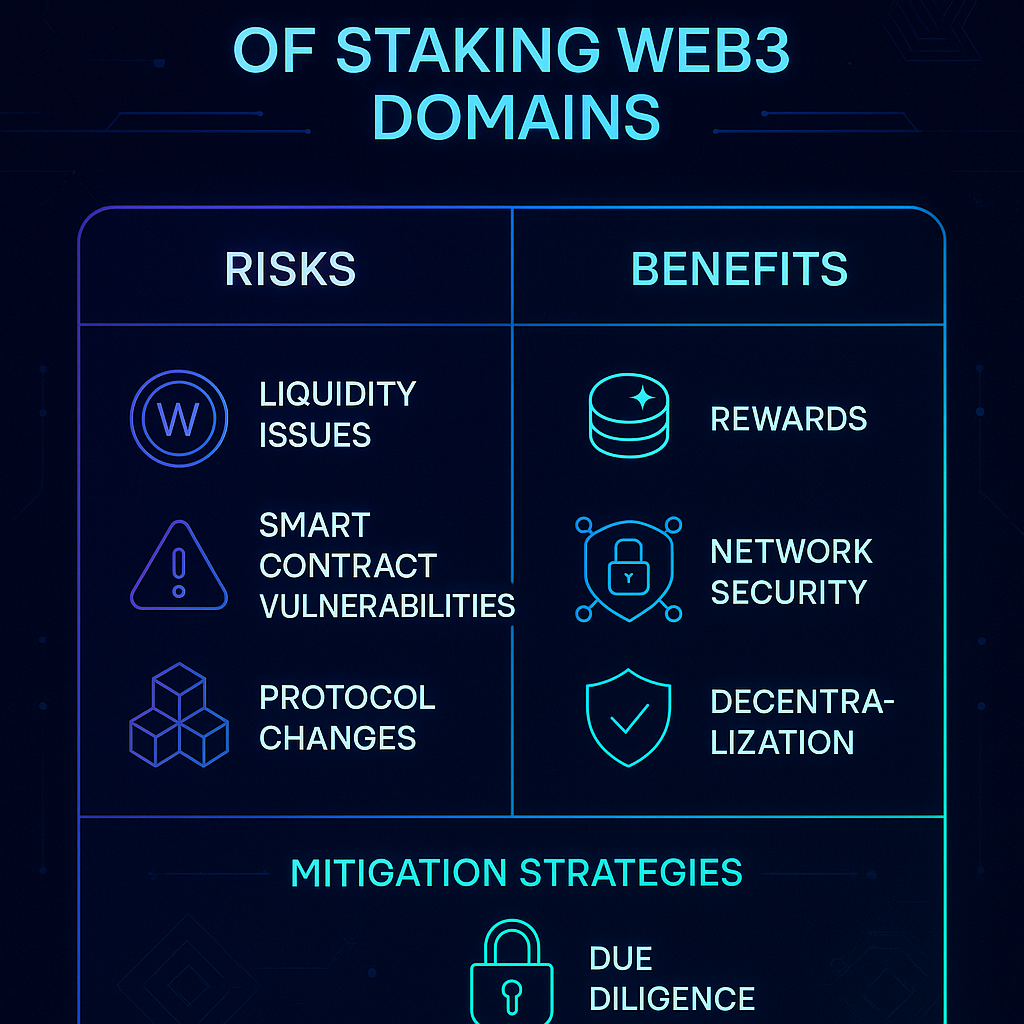

Staking in the world of Web3 is both empowering and challenging. Understanding the spectrum of risks and rewards—and employing strategies for mitigation—is key to long-term success.

Potential Risks and How to Mitigate Them

Some of the major risks and mitigation tactics include:

- Smart contract vulnerabilities: Exploits in unaudited or poorly written contracts can lead to total loss—use only platforms with proven security practices and regular audits.

- Platform security threats: Decentralized does not mean invincible—multi-factor authentication and wallet security are vital.

- Market volatility: Token price swings affect reward values; long-term focus and cautious allocations reduce exposure.

- Regulatory uncertainty: Web3 global regulations are evolving; stay informed about your jurisdiction’s legal standing regarding domain and staking activities.

- Centralization risks: Avoid platforms where governance or control is dominated by a handful of large holders.

Over 70% of new Web3 domain stakers cite passive income, governance, and security as their prime motivations, despite acknowledging challenges with trust and regulatory clarity.

Benefits and Strategic Advantages

Active participation in Web3 staking delivers powerful benefits:

- Passive income: Earn attractive APR rates and rewards for supporting network health and growth (staking web3 domains for passive income streams).

- Governance influence: Help set platform direction—stakeholders have a meaningful say in upgrades, policy, and community funds (governance participation).

- Security and permanence: Staked assets benefit from blockchain’s high-integrity ledgers, with true ownership and resilient protection against censorship or seizure (decentralized domains).

- Digital asset appreciation: Domains staked and actively used are regarded as more valuable in the Web3 market.

The most important value proposition of domain staking is the seamless union of income, influence, and identity ownership enabled by blockchain decentralization.

Future Outlook and Market Trends

The Web3 domain staking space is evolving at a rapid pace. Projected trends include:

- Wider adoption: Institutional involvement and broader user education are accelerating mainstream uptake.

- Integration with DeFi and NFTs: Domain staking is becoming increasingly intertwined with DeFi, fractional investments, and liquid NFT marketplaces.

- Improved user experience: Simplified onboarding, automated staking guides, and advanced analytics dashboards are making participation easier than ever.

- Stronger governance models: Growth in DAOs and on-chain governance will deepen community-led innovation.

- Evolving regulations: Global frameworks will continue to impact platform compliance and user access, demanding continuous adaptation.

With resilient infrastructure, competitive rewards, and growing utility, Web3 domain staking is set to remain an essential pillar of the decentralized internet.

Conclusion

Web3 domain staking brings together the best attributes of blockchain technology—permanent ownership, passive income opportunities, active governance influence, and powerful security features. The transition from traditional DNS to blockchain domains is not simply technical—it is a reimagining of digital identity and community power.

By thoroughly understanding the platforms, staking processes, and governance models, users can maximize the subtle advantages while safeguarding against risks like smart contract exploits and regulatory shifts. Those who act strategically—balancing innovation with caution—stand poised to benefit most as this ecosystem matures.

Explore Web3 domain staking today and start earning passive income while participating in decentralized governance.

Resources

- DNS Vs Web3: Why Only One Requires Renewals

- What is a Web3 TLD?

- Welcome to D3 Docs | D3 Documentation

- Staking System Guide | WORLD3 Docs

- How to Stake ETH in 2025

- Future Now – How we sold ICE.C to ICE.COM for $12,500

- Proof of Efficient Liquidity: A Staking Mechanism for Capital Efficient Liquidity

- Landscape of Staking Providers

- The Tokenomics of Staking

- ICANN – Internet Corporation for Assigned Names and Numbers

- Ethereum

- World Wide Web Consortium (W3C)

- National Institute of Standards and Technology (NIST) – Cryptographic Resources

- Web3 Foundation

- InterPlanetary File System (IPFS)

- Blockchain.com

- NFT Domains Explained

- Web3 Browser Extension Potential

- Web3 Domain Services

- Web3 Domain Hosting

- How to Get a Web3 Domain

- Web3 Statistics Overview

- ICANN vs. Web3 Registrars

- Web3 Global Regulations

Leave a Reply