Table of Contents

The world of digital assets is rapidly evolving, and within it lies a lucrative opportunity: blockchain domain flipping. As Web3 technologies mature, the demand for unique, decentralized digital identities and online real estate is skyrocketing. This emerging market offers significant profit potential for those who understand its nuances. This guide will equip you with the knowledge to navigate this exciting landscape, from understanding the fundamentals of blockchain domains to employing advanced strategies for maximum returns.

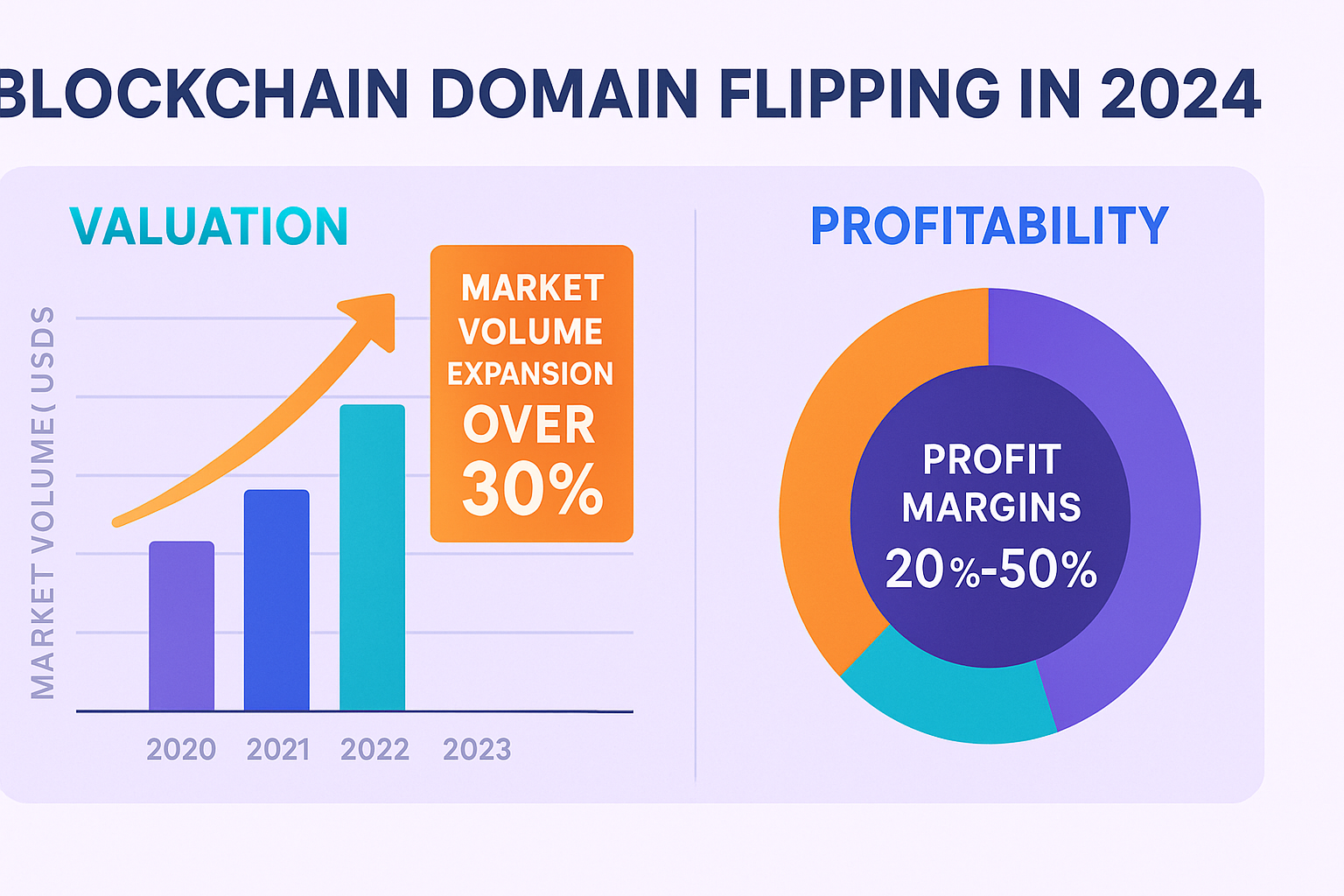

In 2024, the profitability of blockchain domain flipping is particularly pronounced, driven by increasing adoption rates and growing investor interest. This guide aims to demystify the process, providing actionable insights and strategies that capitalize on this trend. We will explore why blockchain domains are becoming increasingly valuable, uncover the best platforms to use, and delve into the critical aspects of valuation, risk management, and legal compliance. By understanding these elements, you can confidently enter the market and start flipping blockchain domains for profit.

Understanding Blockchain Domains

To successfully engage in blockchain domain flipping, a solid understanding of what blockchain domains are, their unique features, and the most popular extensions is crucial. These digital assets are more than just web addresses; they represent a fundamental shift in digital identity and online presence.

Types of Blockchain Domains

- ENS (Ethereum Name Service) Domains: These are native to the Ethereum blockchain, typically ending in

.eth. They are used for wallet addresses, decentralized websites, and as unique identifiers within the Ethereum ecosystem. ENS domains are stored on the blockchain, ensuring security and permanence. - Unstoppable Domains: These domains, such as

.crypto,.nft, and.zil, are registered on various blockchains and offer one-time purchase with no renewal fees. They function as decentralized digital identities, usable across multiple platforms and browsers that support Web3 integration. - HNS (Handshake) Domains: Handshake is a decentralized, permissionless naming protocol implemented on its own blockchain. It aims to replace traditional DNS with a more secure and censorship-resistant system, offering extensions like

.hns.

Key Features and Benefits

- Decentralization: Unlike traditional domains managed by centralized authorities like ICANN, blockchain domains are governed by decentralized networks. This means no single entity can arbitrarily take them away or censor them.

- Censorship Resistance: Their decentralized nature makes them inherently resistant to censorship, ensuring that domain owners have full control over their online presence.

- Ownership Sovereignty: Once purchased, a blockchain domain is owned by the user, typically controlled via a private cryptographic key. This ownership is permanent and transferable, similar to other digital assets like cryptocurrencies or NFTs.

- Enhanced Security: Stored on a blockchain, these domains are secured by cryptographic principles, making them highly resistant to hacking and tampering.

- Interoperability: Many blockchain domains are designed for cross-chain compatibility, allowing them to be used across different blockchain ecosystems, enhancing their utility and value.

- Simplified Transactions: They serve as human-readable alternatives to complex wallet addresses, making crypto transactions more accessible and user-friendly.

Popular Blockchain Domain Extensions

- .eth: The native extension for the Ethereum Name Service, highly valued for its integration with the Ethereum ecosystem, DeFi, NFTs, and decentralized applications (dApps).

- .crypto: Offered by Unstoppable Domains, this extension is widely recognized for branding, digital identity, and payments within the broader crypto space.

- .nft: Popular among creators and collectors, this extension is associated with Non-Fungible Tokens and digital art, attracting a specific niche within the Web3 market.

- .zil: Associated with the Zilliqa blockchain, this extension is gaining traction for its use in specific blockchain communities and projects.

Where to Buy and Sell Blockchain Domains

Successfully flipping blockchain domains requires leveraging the right marketplaces. These platforms offer liquidity, facilitate transactions, and provide the necessary tools for trading digital domain assets.

Top Marketplaces for Trading

- OpenSea: As the largest marketplace for NFTs and crypto assets, OpenSea lists many blockchain domains, particularly those minted as NFTs. It offers wide exposure and high liquidity, making it ideal for trading various Web3 domains.

- Unstoppable Domains: This platform is a primary source for purchasing domains like

.crypto,.nft, and.zil. It also has a marketplace for secondary sales, allowing owners to list and sell their domains directly. - ENS Marketplace: For

.ethdomains, the Ethereum Name Service ecosystem includes various secondary market platforms where users can buy, sell, and auction expired or premium.ethnames. - Namecheap Marketplace: Traditional domain registrars like Namecheap have also integrated Web3 domains, offering a familiar interface for users looking to trade these assets.

These platforms provide essential services like escrow, secure transaction processing, and domain listing functionalities, crucial for both buyers and sellers in the blockchain domain flipping market.

Platform Features and Fees

- Escrow Services: Reputable platforms offer escrow services to secure transactions, ensuring that both parties fulfill their obligations before the domain and payment are transferred.

- Transaction Fees: Most platforms charge a transaction fee, typically a percentage of the sale price, which can vary. Understanding these fees is critical for calculating blockchain domain flipping profitability.

- Cross-Chain Support: Some platforms support domains from multiple blockchains, enhancing liquidity and trading options.

- Payment Methods: Marketplaces typically accept cryptocurrency payments, primarily ETH, but some may support stablecoins or other digital assets.

- Listing Options: Platforms offer different listing options, such as fixed-price sales, auctions, or make-an-offer formats, catering to various selling strategies.

Safe trading on blockchain domain platforms involves several key practices:

- Verify Ownership: Always confirm that the domain listed for sale is legitimately owned by the seller and is not associated with any ongoing disputes or trademark claims.

- Use Reputable Platforms: Stick to well-known marketplaces like OpenSea, Unstoppable Domains, and established ENS aggregators to minimize the risk of scams.

- Secure Your Wallet: Protect your crypto wallet with strong passwords, enable two-factor authentication, and never share your private keys or seed phrases.

- Beware of Scams: Be cautious of phishing attempts, fake listings, or unsolicited offers. Always double-check URLs and seller reputations.

- Understand Fees: Ensure you are aware of all platform and network transaction fees before finalizing any purchase or sale.

Valuation and Profitability of Blockchain Domains

Determining the value of a blockchain domain is key to successful flipping. Several metrics and market factors contribute to a domain’s worth and potential profitability.

Key Valuation Metrics

- Domain Length and Memorability: Shorter, more memorable names are generally more valuable. Single-word or short, catchy phrases are highly prized.

- Extension Popularity: Domains with extensions like

.eth,.crypto, and.nftoften command higher prices due to widespread adoption and utility. - Keyword Relevance: Domains containing popular or commercially relevant keywords can attract higher bids, especially if they align with trending industries or brands.

- Market Demand and Trends: Observing current market trends, project launches, and community interest in specific domains or extensions is crucial for identifying high-demand assets.

- Liquidity: The ease with which a domain can be sold is a key factor. Domains listed on active marketplaces with a history of sales are more liquid and easier to flip.

- Historical Sales Data: Analyzing past sales of similar domains provides benchmarks for valuation and helps predict potential resale prices.

Profit Margins and Case Studies

The profit margins in blockchain domain flipping can be substantial, often exceeding those in traditional domain speculation. Investors have reported returns ranging from 20% to over 100%, particularly for premium or trending domains.

For instance, an investor might acquire an expired .eth domain with a sought-after keyword for a modest fee and later sell it for thousands of dollars to a brand or project looking to establish a Web3 presence. Institutional investors have also entered the space, with some reportedly netting millions from strategic holdings in ENS domains. These success stories highlight the significant financial upside, though they also underscore the importance of strategic acquisition and timing.

Despite the high potential rewards, blockchain domain flipping risks are present:

- Market Volatility: The value of blockchain domains can fluctuate significantly due to market sentiment, regulatory changes, and the overall crypto market performance.

- Liquidity Issues: Some domains, especially those with less popular extensions or less desirable names, may be difficult to sell quickly.

- Scams and Fraud: The relatively new and sometimes unregulated nature of the market makes it susceptible to fraudulent activities.

- Trademark Disputes: Acquiring domains that infringe on existing trademarks can lead to legal challenges and loss of the asset.

To mitigate these risks, investors should:

- Conduct Thorough Research: Analyze market trends, domain utility, and potential buyer demand before purchasing.

- Diversify Portfolio: Spread investments across different extensions and types of domains to reduce concentration risk.

- Use Secure Platforms: Trade only on reputable marketplaces with robust security features.

- Stay Informed: Keep abreast of legal developments, regulatory changes, and emerging Web3 trends.

- Verify Trademarks: Perform trademark searches to avoid potential legal conflicts.

Advanced Strategies: Cross-Chain Arbitrage and Expired Domains

Beyond basic buying and selling, advanced strategies can significantly boost blockchain domain flipping profitability. These include cross-chain domain arbitrage and leveraging expired ENS domains.

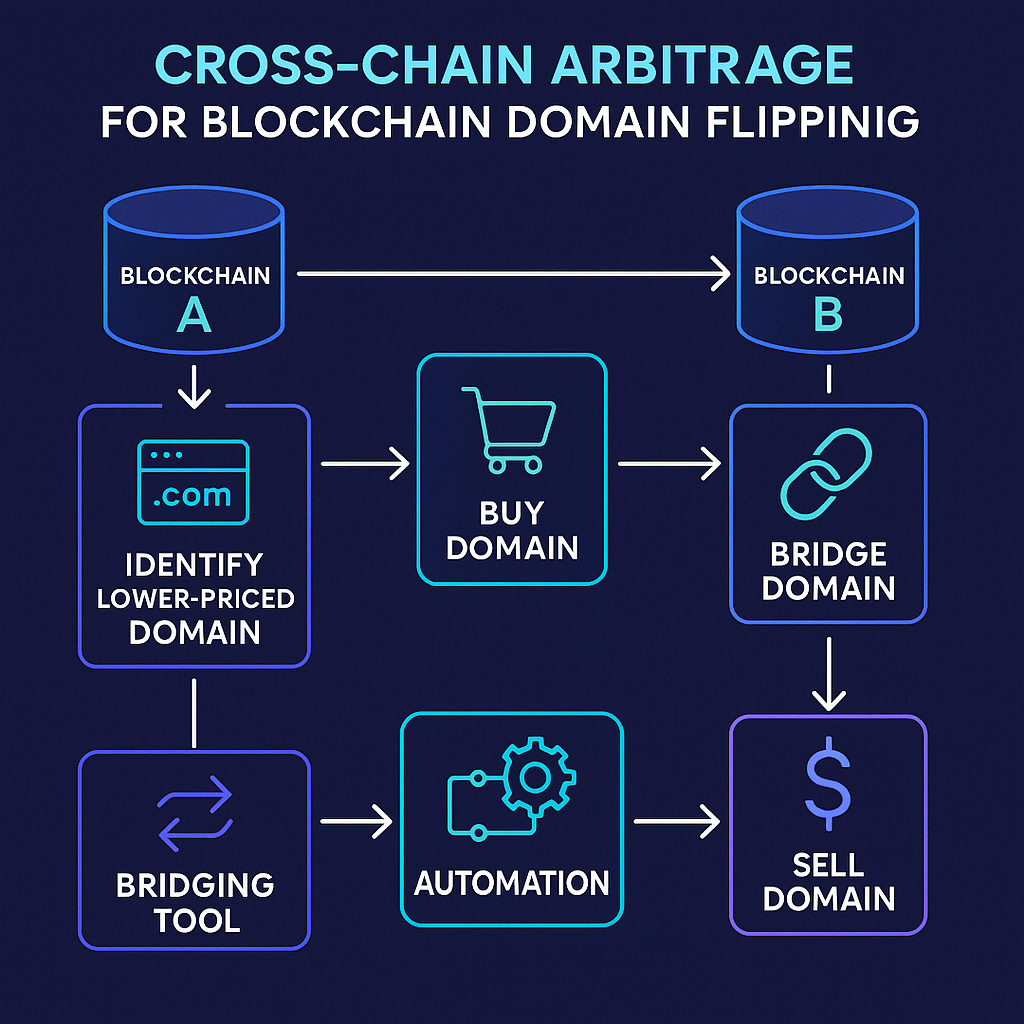

Cross-chain domain arbitrage involves exploiting price differences for the same domain across different blockchain marketplaces or networks. For example, a domain might be listed at a lower price on one blockchain before its price adjusts across the wider market. By identifying these discrepancies and quickly buying low on one platform and selling high on another, traders can profit from these temporary inefficiencies. This strategy requires tools and a deep understanding of how domains trade across various blockchain ecosystems.

Effective cross-chain domain arbitrage tools are essential for capitalizing on these opportunities. Platforms like D3 provide analytics dashboards that track domain prices and liquidity across multiple blockchains in real-time. Other tools may include:

- Price Aggregators: These tools scan various marketplaces for matching domain listings.

- Automation Scripts/Bots: For rapid execution, automated trading bots can monitor prices and place buy/sell orders automatically when arbitrage conditions are met.

- Bridging Solutions: Secure and efficient cross-chain bridging services are necessary to move assets between different blockchain networks to execute trades.

Expired ENS domains present a particularly attractive opportunity for domain flippers. When an .eth domain owner fails to renew their registration, the domain becomes available for others to claim or purchase. Savvy investors monitor expiration lists and bid on these domains, often acquiring them at a fraction of their potential resale value. This strategy requires diligent monitoring and quick action.

To effectively acquire these assets, expired ENS domains finder tools are invaluable. These tools scan the ENS registry for domains nearing expiration or those that have recently expired. They often provide insights into the domain’s potential value based on its name, length, and related keywords. By using these tools, investors can identify prime candidates for acquisition, often before they become widely available on public marketplaces, thus increasing the chances for a profitable flip.

Legal and Tax Considerations

Navigating the legal and tax implications of blockchain domain flipping is critical for long-term success and compliance. Understanding potential risks and obligations is as important as mastering market strategies.

Legal Risks in Domain Flipping

- Trademark Infringement: Acquiring domains that closely match existing trademarks can lead to legal disputes, cease-and-desist letters, or asset seizure. It is crucial to perform trademark searches before purchasing domains.

- Intellectual Property Rights: The ownership and transfer of blockchain domains, while secured by blockchain, may still be subject to intellectual property laws of various jurisdictions.

- Jurisdictional Concerns: The decentralized nature of blockchain can create complexities regarding which laws apply in case of disputes, especially in cross-border transactions.

Tax Implications and Compliance

- Blockchain domain flipping tax implications: Generally involve reporting profits as capital gains or income, depending on local tax laws.

- Capital Gains Tax: When you sell a domain for more than you paid for it, the profit is often treated as a capital gain, subject to specific tax rates.

- Income Tax: If domain flipping is considered a regular business activity, profits might be taxed as ordinary income.

- Record Keeping: Meticulous record-keeping of all acquisition costs, sale proceeds, transaction fees, and relevant expenses is essential for accurate tax reporting and compliance.

Maintaining clear and organized records for blockchain domain transactions is vital for legal and tax purposes. This includes:

- Documenting purchase price, date, and platform used.

- Recording sale price, date, and buyer information (if available).

- Tracking all transaction fees (network fees, marketplace commissions).

- Saving copies of all purchase agreements, invoices, and communication logs.

Using specialized crypto accounting software or maintaining detailed spreadsheets can simplify this process, ensuring all necessary data is readily available for tax filing or in case of audits.

Understanding the legal and tax implications of blockchain domain flipping is critical for long-term success and compliance. This includes:

- Legal risks such as trademark infringement and intellectual property issues.

- Tax implications including capital gains and income taxes.

- Importance of meticulous record keeping and consulting with professionals.

Conclusion

Blockchain domain flipping presents a dynamic and potentially highly profitable avenue within the burgeoning Web3 ecosystem. By understanding the intricacies of these digital assets, leveraging reputable blockchain domain marketplaces, and employing strategic valuation techniques, investors can capitalize on the growing demand for decentralized digital identities.

### Summary of Key Points

We’ve explored the essential aspects of blockchain domain flipping, from understanding the types and benefits of domains like .eth and .crypto to navigating marketplaces such as OpenSea and Unstoppable Domains. Key strategies include focusing on popular blockchain domain extensions, careful blockchain domain valuation, and harnessing advanced techniques like cross-chain domain arbitrage and acquiring expired ENS domains. We’ve also touched upon the crucial legal and tax implications, emphasizing the need for due diligence and meticulous record-keeping to ensure compliance and mitigate blockchain domain flipping risks.

The opportunity to profit from blockchain domain flipping is substantial in 2024. By arming yourself with the knowledge from this guide, you are well-equipped to identify valuable domains, execute profitable trades, and build a successful portfolio in this exciting market. Remember to stay informed about market trends, prioritize security, and always conduct thorough research.

Start flipping blockchain domains today with trusted platforms and maximize your Web3 investment potential!

Leave a Reply