Table of Contents

- Introduction

- Understanding Blockchain Domains

- Where to Buy and Sell Blockchain Domains

- Valuation and Profitability of Blockchain Domains

- Advanced Strategies: Cross-Chain Arbitrage and Expired Domains

- Legal and Tax Considerations

- Conclusion

Introduction

Blockchain domain flipping is rapidly emerging as a lucrative venture within the expanding Web3 ecosystem. As decentralized digital identity becomes more critical, the buying and selling of blockchain-based domain names have ushered in a new era of digital asset investment. This guide dives deep into what blockchain domain flipping entails, why it’s growing exponentially profitable in 2024, and how savvy investors and enthusiasts can capitalize on this innovative market. Through comprehensive details, explanations, and actionable strategies, we aim to equip you with the knowledge to thrive.

What is Blockchain Domain Flipping?

At its core, blockchain domain flipping involves purchasing blockchain-registered domain names at a lower price with the intention of reselling them later for a profit. Unlike traditional domain flipping, these domains operate on decentralized blockchain networks like Ethereum and offer enhanced features such as censorship resistance, ownership transparency, and integration with Web3 apps. These domains serve not only as website addresses but also as digital identities, cryptocurrency wallet addresses, and decentralized app login credentials, making them increasingly valuable in the growing Web3 landscape.

Why Blockchain Domain Flipping is Profitable in 2024

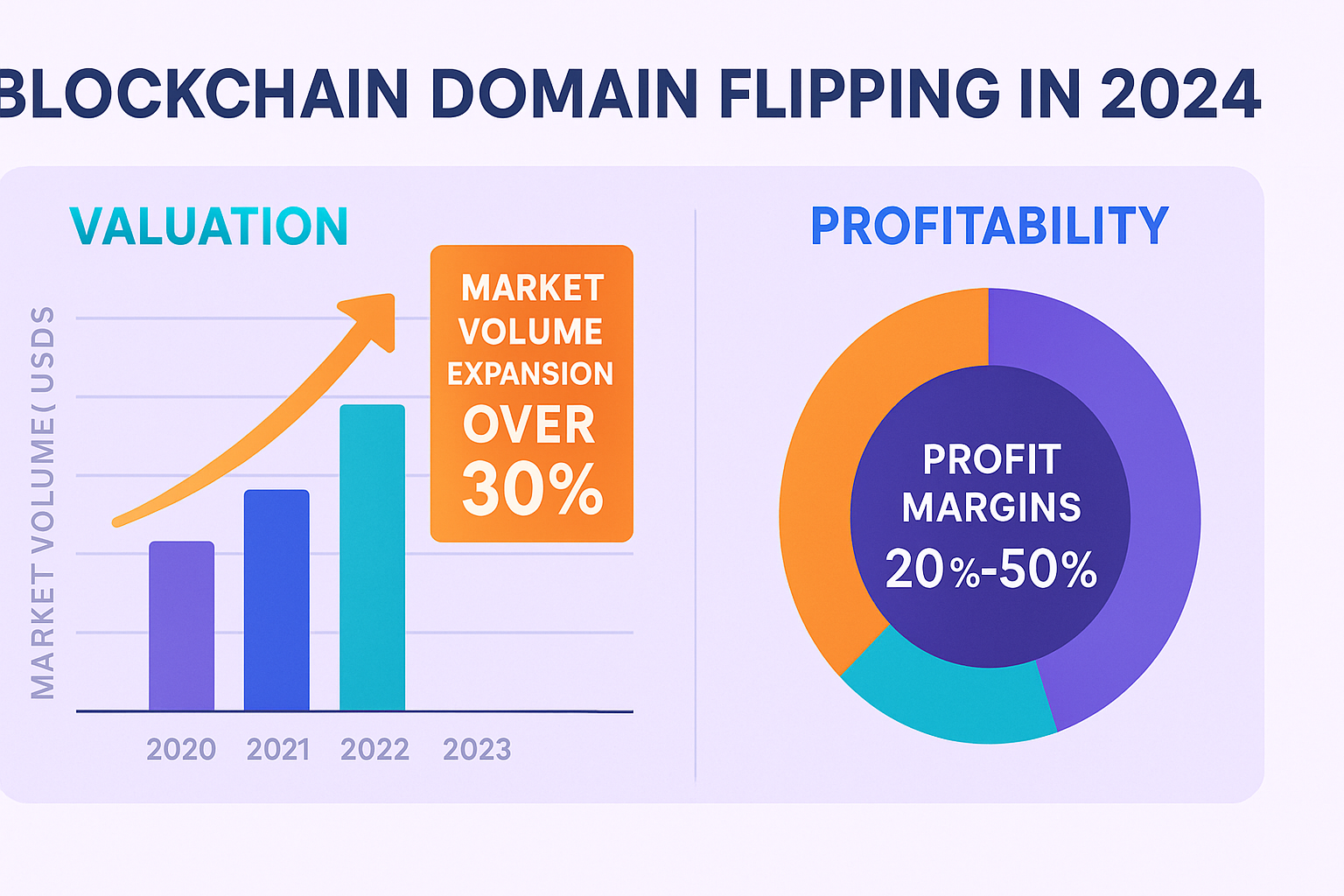

The profitability of blockchain domain flipping in 2024 is driven by several pivotal market forces. First, there is a surge in demand from Web3 users — including businesses, developers, marketers, and users keen to establish secured and censorship-resistant online identities. The rapid expansion of Web3 domains — like .eth, .crypto, and emerging extensions — has also inflated the market volume by more than 30% this year, with profit margins from flips commonly ranging between 20% and 50%. Furthermore, increasing corporate adoption of blockchain domains as part of digital marketing and branding strategies amplifies demand and value appreciation. Platforms supporting seamless bidding, auctioning, and cross-chain transfers facilitate liquidity and broader market participation, fortifying the profitability ecosystem.

Overview of This Guide

This guide is structured to provide you with a 360-degree understanding of blockchain domain flipping. We cover the fundamental concepts, including different domain types and their features, alongside market-leading platforms where you can buy and sell Web3 domains. You’ll learn how to gauge the value of blockchain domain names using key valuation metrics and explore successful profit models bolstered by real-world case studies. Advanced sections introduce innovative techniques like cross chain domain arbitrage strategies and leveraging expired ENS domains finder tools. Lastly, essential legal and tax compliance insights ensure you’re aware of risks and responsibilities. Whether you’re a newcomer or experienced flipper, this comprehensive manual prepares you for success.

Understanding Blockchain Domains

Understanding the types, features, and popular extensions of blockchain domains is essential for informed investment decisions. These domains are not just tech novelties; they represent a secure and autonomous digital identity ecosystem optimized for Web3.

Types of Blockchain Domains

Blockchain domains come in various types, with some of the most prominent being the Ethereum Name Service (ENS) domains, Unstoppable Domains, and others like Handshake (HNS) and 3DNS. ENS domains, such as .eth, are predominantly used on the Ethereum blockchain and are prized for their integration with decentralized apps and wallets. Unstoppable Domains provide domains under .crypto, .zil, and recently expanded extensions, focusing on smooth usability combined with integrated blockchain payments and censorship resistance. Each type differs in protocol, supported chains, renewal models, and scalability.

Key Features and Benefits

Among their critical benefits, blockchain domains boast decentralization — they are stored on blockchain ledgers, ensuring users retain true ownership without centralized authority interference. This architecture provides censorship resistance, so domains cannot be arbitrarily taken down. Moreover, these domains serve as identifiers for cryptocurrency wallets, simplifying transactions. They also enable seamless integration with decentralized applications (dApps), enhancing user experience within Web3 ecosystems. This suite of benefits positions blockchain domains as foundational assets in the future of digital identity and internet infrastructure.

Popular Blockchain Domain Extensions

The most well-known blockchain domain extensions in 2024 include .eth (Ethereum Name Service), .crypto, .nft, .zil, and the rising .dao domains tailored for decentralized autonomous organizations. Each extension targets different user needs and blockchain backends. For instance, .eth domains are favored for Ethereum-based activity and have the most mature marketplace, while .crypto focuses on broader compatibility with multiple chains. The emergence of niche domain types signals expanding application scopes, making diversified portfolio management crucial for flippers aiming to capture varied market segments.

Where to Buy and Sell Blockchain Domains

Top Marketplaces for Trading

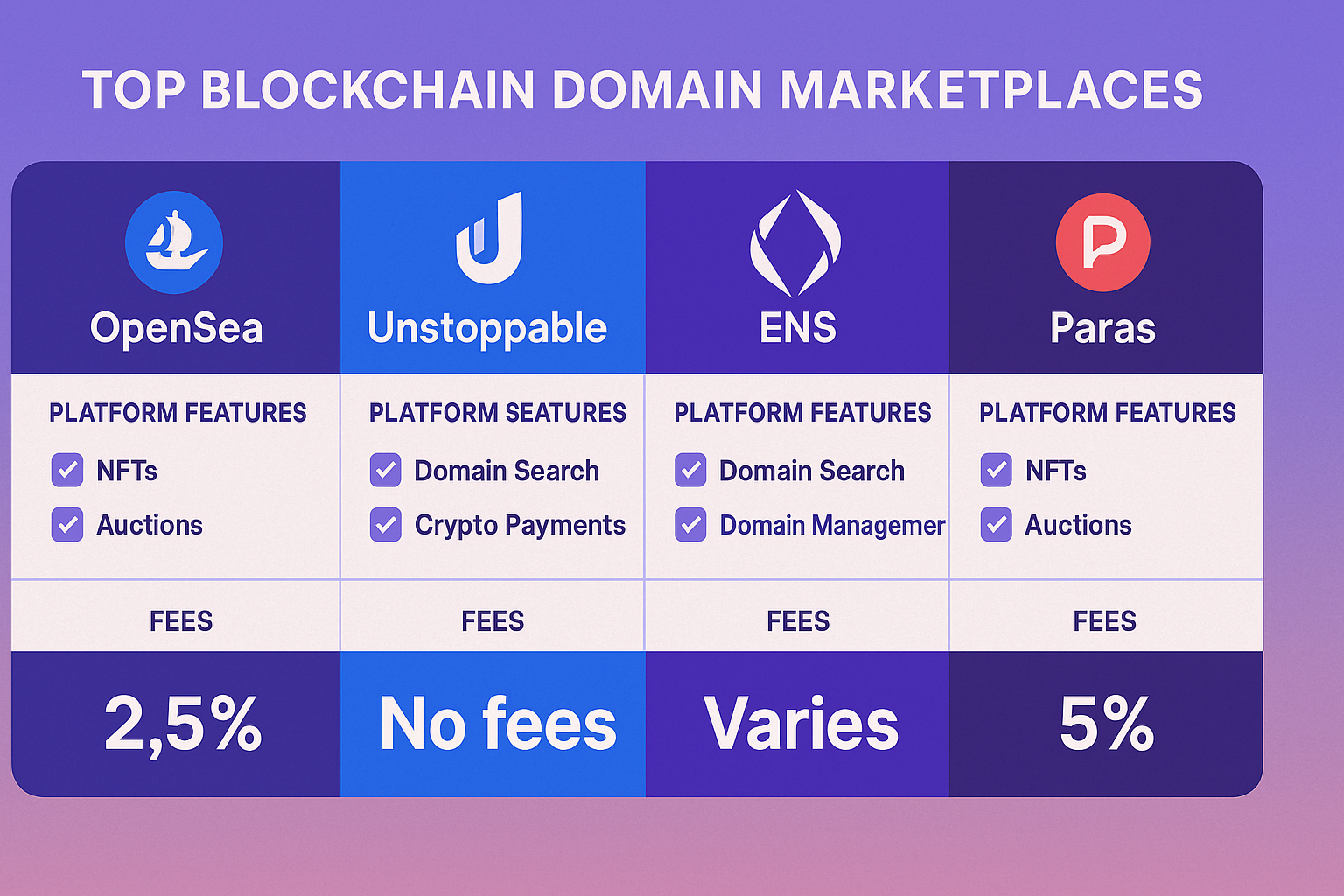

Leading blockchain domain trading platforms include the influential OpenSea marketplace, the user-centric Unstoppable Domains platform, the Ethereum Name Service (ENS) marketplaces, and Paras. OpenSea stands out as the largest decentralized NFT marketplace hosting thousands of blockchain domains for sale, offering bidding systems and auctions. Unstoppable Domains provides a fixed-price sale model accessible globally, while ENS marketplaces leverage Ethereum’s security for transparent transfers. Paras focuses on NFT-centric domain assets, broadening the trading ecosystem.

Platform Features and Fees

Each marketplace offers distinct features and fee structures. OpenSea charges a moderate 2.5% creator fee on secondary sales, plus Ethereum gas fees depending on network congestion. Unstoppable Domains implements a flat fee for domain purchases without ongoing royalties, ideal for cost predictability. ENS transactions involve gas fees for domain registration and transfer, with no additional marketplace fees. Features such as escrow services, cross-chain support, and payment flexibility distinguish these platforms, impacting overall profitability when flipping domains.

How to Use These Platforms Safely

Safety is paramount in blockchain domain flipping, necessitating vigilance against scams and fraudulent listings. Always verify domain ownership through blockchain explorers and use marketplaces that provide escrow or dispute resolution mechanisms. Employ hardware wallets and two-factor authentication for account security. Conduct thorough due diligence before transactions, and be wary of suspiciously low prices or offers that pressure quick decisions. By adhering to secure practices, users can significantly reduce exposure to blockchain domain flipping scams and safeguard investments.

Valuation and Profitability of Blockchain Domains

Key Valuation Metrics

Valuing a blockchain domain involves a blend of on-chain and off-chain factors. Important metrics include domain length (short domains often hold higher value), keyword relevance and brandability, age of the domain, and its blockchain ecosystem. Historical sales data and liquidity signals inform market demand, while technical aspects such as the domain’s integration with popular dApps add utility-driven value. Advanced tools provide analytics on transfer frequency and holder activity to fine-tune valuation. Incorporating these insights helps align investment choices with market realities for increased success.

Profit Margins and Case Studies

Flipping blockchain domains has yielded substantial profit margins for investors. Case studies reveal flips returning between 20% to over 100% profit. For example, investors who acquired early .eth domains have seen their assets appreciate multiples since initial purchases. Institutional players leveraging data-driven strategies in ENS domains have netted millions in profit by specializing in premium name segments and timing auction participation effectively. These success stories underscore the viability of blockchain domain flipping as a scalable investment model.

Key Insight: Understanding market cycles and key valuation metrics is crucial — as seen in recent stories of institutional investors generating over $8 million in profits flipping ENS domains.

Risks and How to Mitigate Them

While profits can be attractive, risks are inherent in blockchain domain flipping. Market volatility can impact domain prices sharply, and scams remain prevalent in nascent marketplaces. Legal uncertainties over intellectual property and trademark infringement pose additional challenges. To mitigate these risks, conduct thorough due diligence, use trustworthy trading platforms, diversify domain portfolios, and stay informed on legal regulations. Secure transaction tools and professional legal advice can safeguard assets and reduce exposure to blockchain domain flipping risks.

Advanced Strategies: Cross-Chain Arbitrage and Expired Domains

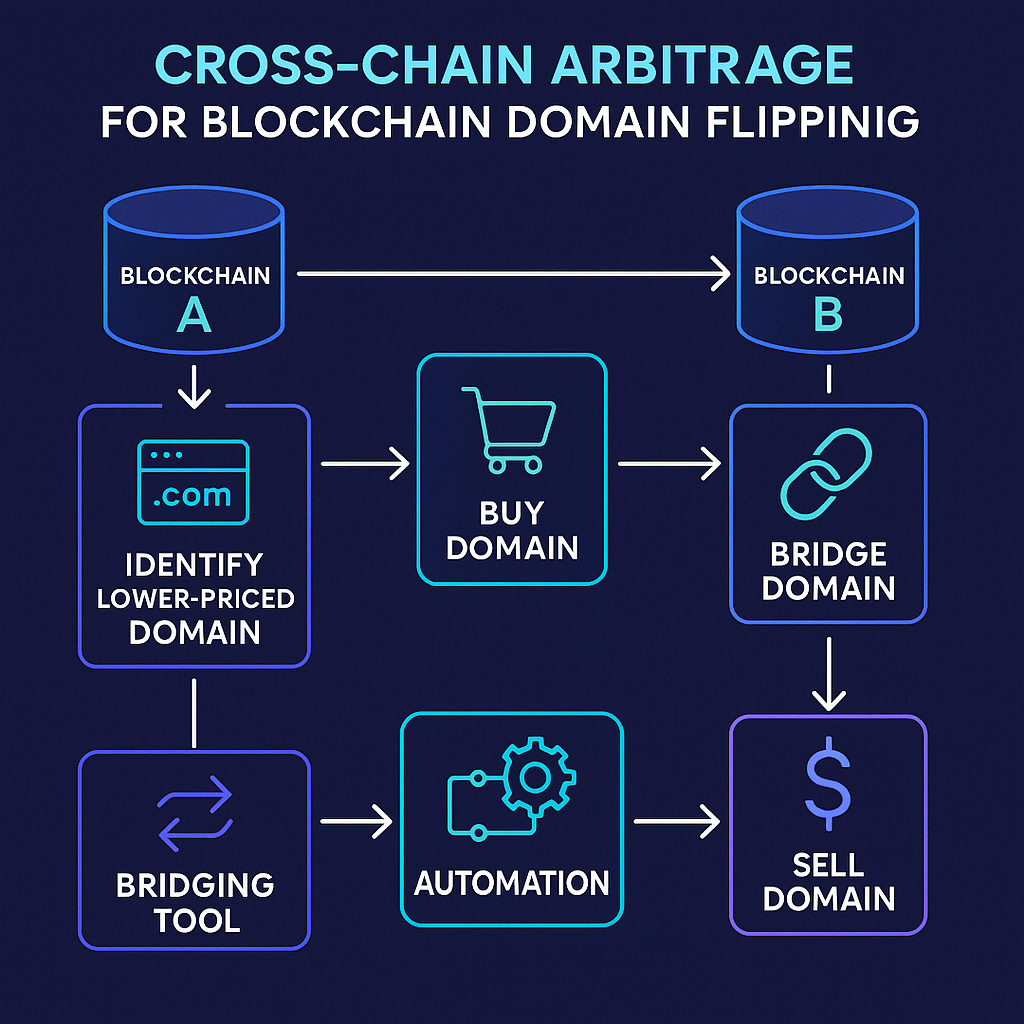

Cross-Chain Domain Arbitrage Explained

Cross-chain domain arbitrage involves capitalizing on price discrepancies for the same or similar blockchain domains across multiple blockchain ecosystems and marketplaces. By monitoring different listings, traders detect undervalued domains on one chain, purchase them, and subsequently resell them on chains or platforms where demand and prices are higher. This strategy benefits hugely from interoperability protocols like CCIP and domain bridging tools, enabling seamless transfers without losing ownership. Speed and accuracy in market analysis underpin successful arbitrage execution.

Tools for Cross-Chain Arbitrage

Effective cross-chain arbitrage relies on automation and analytics tools that track domain prices, liquidity, and trends across blockchains in real time. Platforms such as variant.fund offer comprehensive dashboards and APIs for market data, while bridging protocols provide the technical backbone for domain transfers across chains. Utilizing these tools reduces manual effort, enhances strategic decision-making, and increases profitability by exploiting fleeting arbitrage opportunities.

Using Expired ENS Domains for Flipping

Expired ENS domains represent a lucrative category within domain flipping. When domains expire due to non-renewal, they become available for new bids and purchases. Successful flippers monitor expiry schedules and strategically bid on high-potential names with recognizable keywords or demand. Timing the auction and bidding strategically can lead to acquiring domains at below-market prices, which can then be sold at a premium in an active marketplace.

Expired ENS Domains Finder Tools

Specialized expired ENS domains finder tools automate the discovery process by providing real-time updates on soon-to-expire or recently expired domains. These tools often incorporate filters based on keyword relevance, past ownership history, and potential market value. Using these automated platforms optimizes inventory acquisition and helps flippers scale their domain portfolios effectively.

Legal and Tax Considerations

Legal Risks in Domain Flipping

Legal challenges in domain flipping primarily center around intellectual property and trademark infringement. Some domain names may conflict with trademarked brands, opening the door to disputes and potential litigation. Additionally, jurisdictional variability means that rules differ by region, requiring careful navigation. Staying informed on blockchain domain flipping legal considerations and consulting legal professionals specializing in digital assets mitigate many pitfalls.

Tax Implications and Compliance

Profits derived from blockchain domain sales are taxable in most jurisdictions under capital gains or income regulations. Understanding local tax laws and reporting requirements is vital to ensure compliance. Keeping detailed records of purchase prices, sale proceeds, and transaction dates supports accurate tax reporting. Awareness of blockchain domain flipping tax implications helps avoid costly audits and penalties.

Best Practices for Record Keeping

Effective record keeping is a pillar of sustainable flipping operations. Use digital ledger tools, spreadsheets, or dedicated crypto portfolio managers to document transaction histories, including invoices, receipts, and communications with buyers and sellers. This practice not only simplifies tax compliance but also provides transparency and evidence in case of disputes or audits, safeguarding your investment journey.

Conclusion

Blockchain domain flipping represents a dynamic and profitable frontier in digital asset investing within the booming Web3 space. This comprehensive guide has unpacked the fundamental aspects—from understanding domain types and platforms, through valuation and profitability nuances, all the way to advanced strategies that enhance returns like cross-chain arbitrage and expired domain acquisition.

Summary of Key Points

- Profitability of blockchain domain flipping has surged in 2024 due to growing demand, with profit margins often ranging between 20% and 50%.

- Key marketplaces like OpenSea marketplace and ENS platforms provide essential venues to buy and sell Web3 domains.

- Understanding blockchain domain valuation metrics and market cycles is crucial for maximizing returns.

- Advanced flipping techniques such as cross chain domain arbitrage strategies and leveraging expired ENS domains finder tools can significantly boost profitability.

Final Thoughts and Next Steps

Taking action on your blockchain domain flipping journey is now more accessible and promising than ever. With robust platforms, strategic tools, and a growing Web3 economy backing digital identity ownership, the time to capitalize is ripe. Begin by researching your niche, register or purchase valuable domains, and diligently apply the valuation and risk mitigation strategies outlined here. Stay secure, stay compliant, and above all, stay proactive in this evolving market.

Start flipping blockchain domains today with trusted platforms and maximize your Web3 investment potential!

Leave a Reply