Table of Contents

Introduction

What is Blockchain Domain Flipping?

Blockchain domain flipping refers to the practice of purchasing blockchain-based domain names with the intent to resell them at a profit. These domain names are unique digital assets recorded on decentralized blockchains, providing ownership transparency and censorship resistance. Unlike traditional domain flipping, blockchain domains operate within the Web3 ecosystem, enabling users to control their digital identities and assets securely. This emerging market allows investors to capitalize on rising demand for decentralized digital real estate.

Why Blockchain Domain Flipping is Profitable in 2024

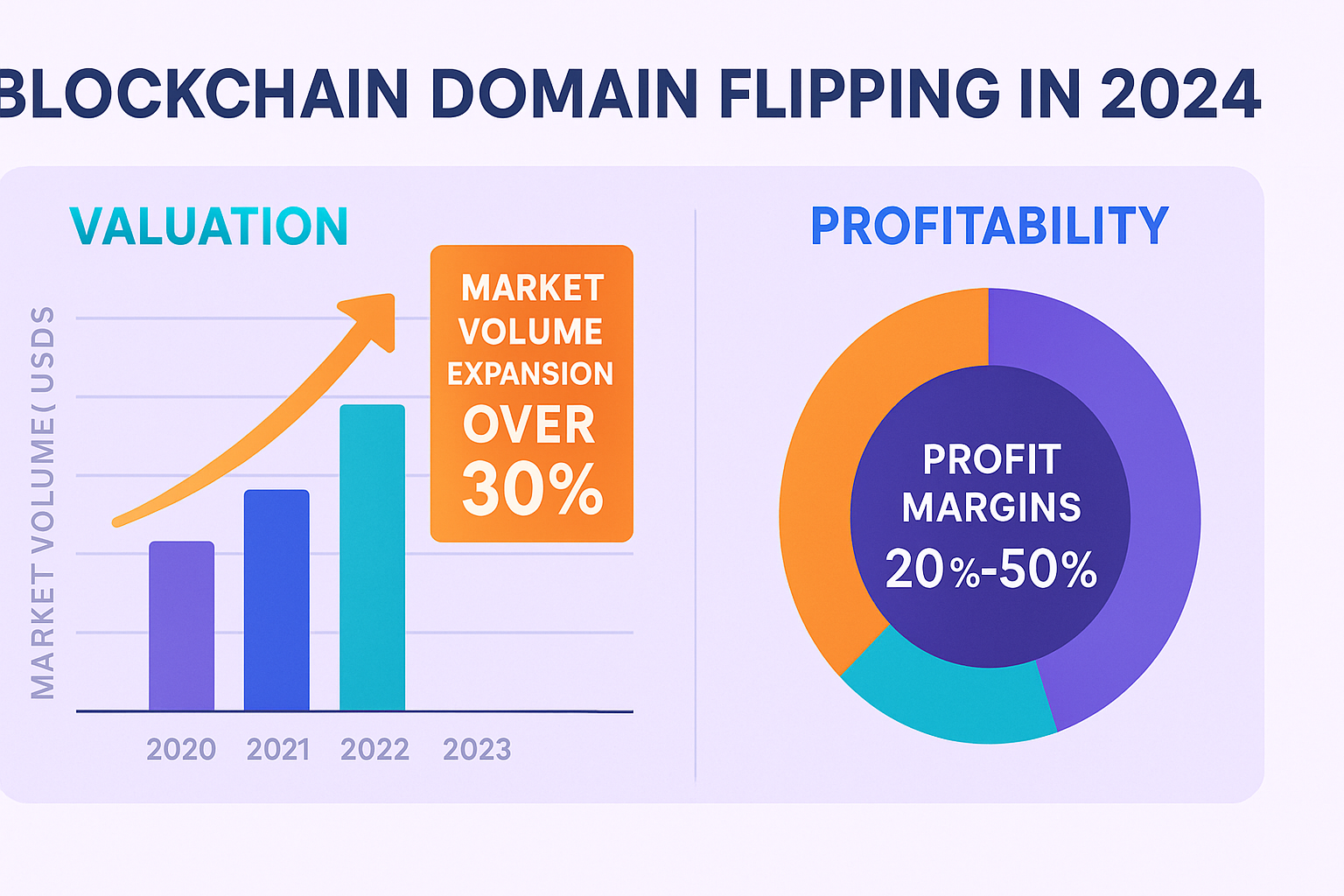

In 2024, blockchain domain flipping has become increasingly profitable due to several key factors. The rapid growth of Web3 technologies, NFTs, and decentralized applications has fueled demand for blockchain domains, especially premium names in domains like .NFT, .Crypto, and .Eth. Market reports show the blockchain domain flipping market expanded over 30% this year, with profit margins ranging from 20% to 50% on successful flips.

Furthermore, increased adoption of decentralized digital identity systems and integration with blockchain-based wallets and apps drive the utility and value of these domains. As more businesses and individuals seek to own branded domains in the decentralized space, the scarcity of quality names continues to push prices upward, creating lucrative opportunities for domain investors.

Overview of This Guide

This comprehensive guide is designed to equip you with the knowledge and tools to succeed in blockchain domain flipping. We’ll start by explaining the types of blockchain domains and their unique benefits, then explore where to buy and sell Web3 domains safely. You’ll learn how to value blockchain domain names, understand key profitability metrics, and examine real-world flipping case studies.

Advanced strategies like cross-chain domain arbitrage and sourcing expired ENS domains are covered with practical advice on tools and automation. Finally, we’ll address legal and tax considerations, helping you navigate risks and compliance. Whether you are a beginner or an experienced investor, this guide provides actionable insights to maximize your Web3 domain investment potential.

Understanding Blockchain Domains

Types of Blockchain Domains

Blockchain domains come in several types, each associated with a distinct blockchain ecosystem and offering unique features:

- Ethereum Name Service (ENS): The most prominent decentralized naming system operating on the Ethereum blockchain, offering

.ethdomains widely used for Web3 identity and wallets. Ethereum Name Service domains enable simple human-readable addresses linked to complex blockchain hashes. - Unstoppable Domains: This platform supports multiple blockchain TLDs such as

.crypto,.nft, and.walletbacked by Ethereum and Polygon blockchains. These domains aim for censorship resistance and user-friendly decentralized websites. - Other Blockchain Domains: Emerging blockchains like Binance Smart Chain (BSC) and Solana are introducing their naming systems, providing new domain markets with potential undervalued assets.

Understanding these domain types is crucial for identifying the best flip opportunities across ecosystems.

Key Features and Benefits

Blockchain domains offer a range of compelling benefits compared to traditional domains:

- Decentralization: Control is maintained via blockchain, eliminating centralized registrars and reducing censorship risks.

- Censorship Resistance: Domains cannot be easily seized or taken down by authorities.

- Digital Identity Management: Domains serve as Web3 usernames linked to wallets, apps, and dApps.

- Monetization Opportunities: Owners can lease, sell, or stake domains for passive income.

These features drive the demand for blockchain domains, adding intrinsic value that supports profitable flipping.

Popular Blockchain Domain Extensions

Currently, some of the most popular blockchain domain extensions include:

.eth(Ethereum Name Service).crypto(Unstoppable Domains).nft(Unstoppable Domains).wallet,.x,.bitcoin(various providers)

Emerging TLDs continue to appear as new blockchains adopt decentralized naming. Investors targeting best blockchain domains to invest in should monitor these extensions closely for early acquisition advantages.

Where to Buy and Sell Blockchain Domains

Top Marketplaces for Trading

Trading blockchain domains is facilitated by specialized marketplaces. The leading venues include:

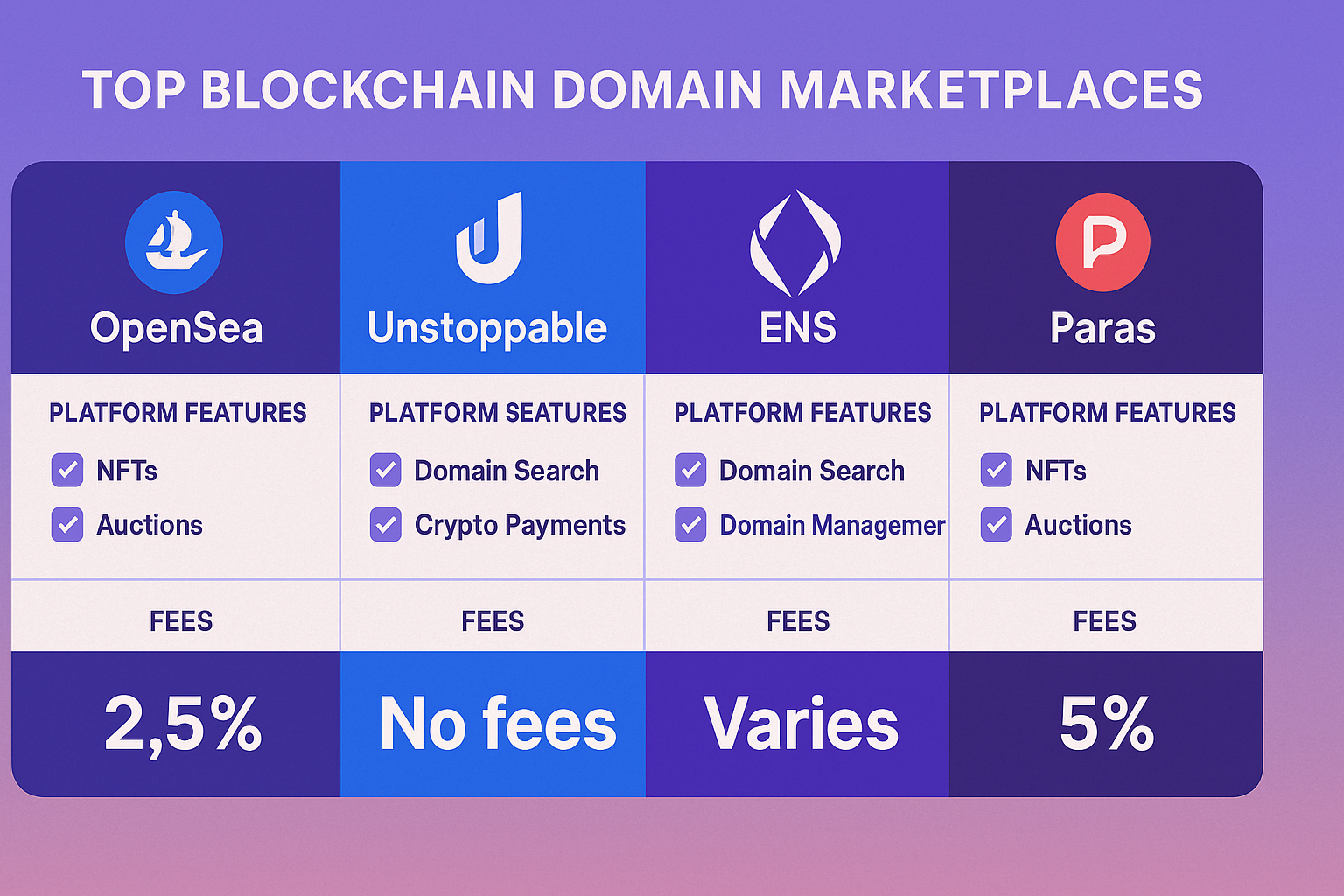

- OpenSea marketplace: The largest NFT marketplace also hosts blockchain domain listings, supporting auction and direct sales.

- Unstoppable Domains platform: Allows registration, sale, and management of domains with seamless Web3 integration.

- ENS Marketplaces: Specific platforms focused solely on

.ethdomains with auction and resale features. - Paras: A growing NFT marketplace supporting diverse blockchain assets, including domains.

Platform Features and Fees

When trading blockchain domains, understanding platform tools and fee structures is critical:

- Escrow and Security: Trusted marketplaces offer escrow services to ensure secure transactions.

- Transaction Fees: Platforms typically charge commissions or gas fees, affecting net profitability.

- Cross-Chain Support: Some platforms support multiple blockchains, enabling diversified portfolios.

- Payment Methods: Accepted payments include cryptocurrencies like ETH, BTC, and stablecoins.

Selecting platforms that balance low fees with security helps maximize returns.

How to Use These Platforms Safely

Safety is paramount in blockchain domain flipping due to scams and fraud risks:

- Verify ownership via blockchain explorers before purchase.

- Use platforms with reputable escrow and dispute resolution.

- Beware of phishing attempts and fake listings.

- Avoid deals outside official marketplaces.

Practicing due diligence reduces the chance of falling victim to blockchain domain flipping scams and protects your investments.

Valuation and Profitability of Blockchain Domains

Key Valuation Metrics

Determining the value of blockchain domains involves several metrics:

- Domain Length: Shorter names generally fetch higher prices.

- Keyword Relevance: Domains including trending Web3 and crypto terms attract more buyers.

- Blockchain Ecosystem: Domains on popular chains like Ethereum are more valuable.

- Liquidity: Historical sales volume of similar domains influences price.

- Historical Sales Data: Previous auction prices provide benchmarks.

Using these factors in tandem helps accurately value blockchain domain names.

Profit Margins and Case Studies

Profit margins on successful flips range typically between 20% and 50%. Several case studies highlight big wins:

- Strategic flips of premium

.ethand.cryptodomains earning upwards of 100% ROI. - Institutional investors netting $8.2 million profit through smart ENS domain holdings and trades.

- Sales like ICE.C to ICE.COM showing how brandable names command premium prices.

These examples demonstrate the viability of blockchain domain flipping as a serious investment strategy.

Risks and How to Mitigate Them

Risks include:

- Market volatility causing sudden price drops.

- Scams and phishing threats.

- Potential legal disputes over intellectual property.

Mitigation strategies:

- Conduct thorough market and legal due diligence.

- Use trusted blockchain domain trading platforms.

- Diversify your portfolio to spread risk.

“Risk management is as important as opportunity spotting in blockchain domain flipping.”

Advanced Strategies: Cross-Chain Arbitrage and Expired Domains

Cross-Chain Domain Arbitrage Explained

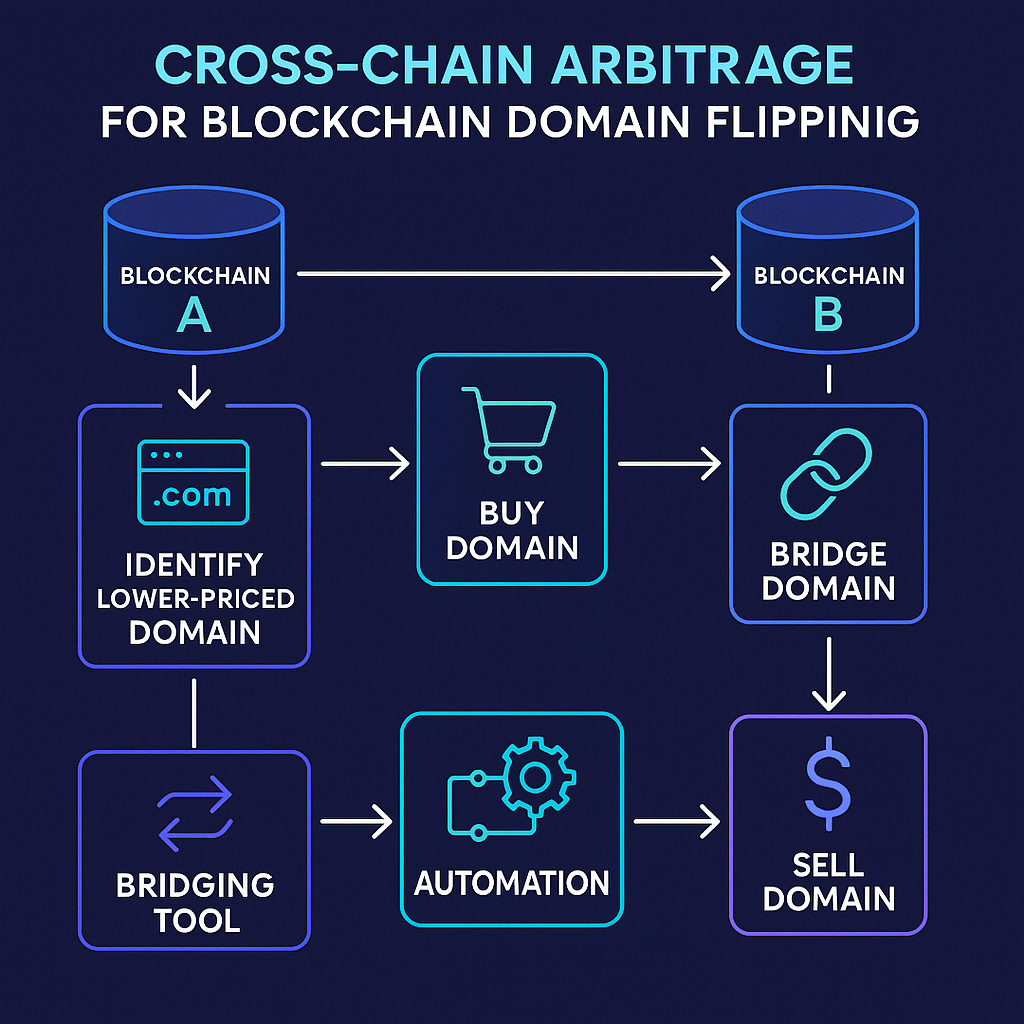

Cross-chain arbitrage exploits price discrepancies of the same or similar domains across different blockchains. For example, a domain undervalued on Polygon may fetch a higher price on Ethereum. Using interoperability protocols such as CCIP, investors bridge domains from one blockchain to another to capitalize on these differences.

This strategy requires understanding blockchain ecosystems, transaction costs, and timing market trends carefully.

Tools for Cross-Chain Arbitrage

Several tools enable efficient cross-chain arbitrage:

- Analytics platforms that compare domain prices across chains.

- Automated bidding and trading bots.

- Bridging services enabling domain transfers between blockchains.

These tools are essential for modern cross chain domain arbitrage strategies.

Using Expired ENS Domains for Flipping

Expired ENS domains can be highly valuable if acquired quickly. Investors track expiration schedules, participate in auctions, and bid strategically on names with strong keywords or brand potential.

Expired ENS Domains Finder Tools

Tools like ENS Manager and other domain expiry trackers automate discovery of soon-to-expire valuable domains, allowing investors to act fast and secure profitable flips. Automated alerts and bidding bots further enhance effectiveness.

Legal and Tax Considerations

Legal Risks in Domain Flipping

Investors face legal risks including:

- Ownership disputes due to decentralized registrar complexities.

- Intellectual property infringement from trademarked names.

- Regulatory uncertainties around digital asset classification.

Adhering to blockchain domain flipping legal considerations and thorough research can mitigate these risks.

Tax Implications and Compliance

Profits from flipping blockchain domains generally attract capital gains taxes. Proper record-keeping of purchases, sales, fees, and income is essential for compliance. Jurisdiction-specific tax rules may apply, and consulting tax professionals familiar with crypto assets is recommended.

Best Practices for Record Keeping

Maintain detailed transaction logs including:

- Purchase and sale dates and prices

- Platform transaction hashes

- Fees and expenses

- Communication records

Using digital tools and spreadsheets helps streamline record-keeping for audits and tax reporting.

Conclusion

Summary of Key Points

Blockchain domain flipping presents a highly profitable opportunity fueled by the expansion of Web3 and decentralized identity technologies. Understanding different blockchain domain types, dominant marketplaces such as the OpenSea marketplace, valuation metrics, and risks is essential. Advanced strategies like cross-chain arbitrage and leveraging expired ENS domains further enhance profitability.

Final Thoughts and Next Steps

Ready to capitalize on this exciting market? Start by researching trusted platforms and using the recommended blockchain domain flipping tools. Stay vigilant for scams, keep thorough records, and diversify your investments. Remember, timing and due diligence are your best allies.

Start flipping blockchain domains today with trusted platforms and maximize your Web3 investment potential!

Leave a Reply